Content

Your Roadmap to Customer Lifetime Value (LTV): An Ultimate Guide

Masha Efy, Creative Writer @ OWOX

As a marketer or business owner, your top priority is keeping your clients loyal. Among the sea of numbers, one metric that stands out and can transform your decision-making is Customer Lifetime Value (LTV).

LTV measures how much a customer contributes over their entire relationship with your company. It can help you pinpoint valuable customers and engage them with offers and rewards.

In this article, we'll explore why LTV is vital for your business, how to calculate the lifetime value of a customer, and how it can strategically influence marketing and business overall.

Defining Customer Lifetime Value (LTV)

Customer Lifetime Value (LTV) is the total money a customer brings to your business throughout their entire time with you.

In other words, it's a way to figure out how much a client spends on your products and services during their whole time as a customer.

A higher LTV means a more valuable client for your business, as they bring in more money and are likely to stay loyal.

Types of Customer Lifetime Value Data

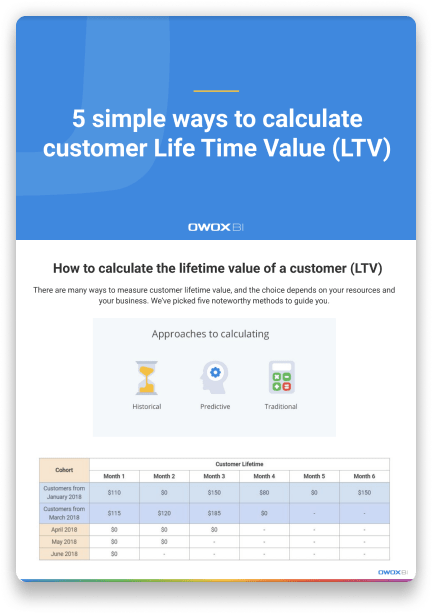

Calculating customer lifetime value involves various methods such as historic LTV, predictive LTV, as well as lifespan LTV, cohort analysis, and individual LTV. Let's take a look at the most popular approaches:

Historic LTV

Historic LTV calculates the value of all past purchases made by a customer. It uses data on their previous transactions within a specific time frame. This method includes costs, such as acquisition cost and marketing expenses, customer service, returns.

The problem with historical models is that they assume all new customers spend the same as past customers on average, which can be inaccurate and lead to false assumptions.

Predictive LTV

Predictive LTV estimates the total value a customer will bring to your business throughout their lifetime. It uses current spending patterns to forecast how much a customer will spend in the future.

This model relies on regression and machine learning to predict future data, making it more advanced than the traditional historical model.

Learn more about

Customer Lifetime Value vs Customer Metrics

To truly grasp the value a customer offers, you can consider the Customer Acquisition Cost (CAC) and Cost to Serve.

While CAC is a pretty much a standard metric, Cost to Serve (CTS) is a financial metric used to analyze and understand the total cost incurred to deliver a product or service to customers. It is a comprehensive approach that takes into account all the direct and indirect costs associated with the entire supply chain and distribution process. The goal of calculating the Cost to Serve is to know the profitability of each individual customers, product, or channel.

The Cost to Serve analysis typically includes the following components:

Direct Costs: these are basically the costs of production, including the cost of raw materials, labor and packaging.

Indirect Costs: the costs that cannot be directly linked to each individual product or service, for example, warehousing, inventory costs, administrative costs, and sales and, finally, marketing expenses.

Delivery Costs: expenses related to the distribution of products, such as shipping and handling costs, and other delivery expenses.

Service Costs: customer support costs, after-sales service, warranty expenses.

By monitoring these metrics over time, you gain insights into customer spending, profitable and unprofitable segments, loyalty, and overall profitability, so you optimize not only marketing, but also operations.

What Makes Customer Lifetime Value Crucial for Your Business?

Customer Lifetime Value is a metric for understanding the long-term value a customer adds to your business. When you examine the customer experience and feedback at different touchpoints, you can see the factors influencing LTV. Customer Lifetime Value is particularly valuable for businesses with continuous relationships, such as streaming platforms, software-as-a-service (SaaS), and membership sites because they rely on recurring revenue. However, traditional e-commerce or brick-and-mortar businesses should not overlook LTV either.

Helps in Estimating Break-Even Points

Comparing LTV to CAC (Customer Acquisition Cost) helps find out how effective are your marketing and sales efforts.

For example, if a customer LTV is $500 and it costs $100 to get that new customer. A good sign of a healthy business model is 3:1 or higher, while a ratio of 5:1 or more means your business is doing exceptionally well. To learn more about optimizing this metric, we recommend reading our guide about LTV:CAC ratio.

Uncover in-depth insights

8 Effective Ways to Increase Customer Lifetime Value

Download nowBonus for readers

Increase Profitability

Boosting LTV means steady profits in the long run. Just depending on new customers might not cut it during slow times. When you have a high LTV, clients keep coming back, bringing reliable income. That lets you confidently invest in growing your business—think expanding internationally and putting more into new offerings or promotion.

Optimize Decision-Making

LTV is a game-changer for your business decisions. It helps with operations: production, workforce, and inventory choices. By understanding your clients, best-selling products or services, and what keeps customers loyal, you won't waste money on unwanted goods or inefficient advertising campaigns.

Implement Holistic Business Strategy

Understanding LTV is vital for developing effective business growth strategies. A low LTV suggests investing in loyalty programs to retain customers, while a high LTV calls for focusing on top-selling products and successful campaigns. Over time, this approach helps create cost-effective customer acquisition, marketing, and sales strategies.

Dive Deeper into Retention

Customer lifetime value reveals your most loyal brand supporters. It tells you how often they shop with you and what they prefer to buy. Understanding this data helps you come up with strategies to engage with these customers and sell them more.

How to Calculate Customer Lifetime Value

By following these steps, you can easily determine LTV for your business:

Step 1: Determine the average order value

Calculate the total revenue generated from all customer orders within a specific time frame, and then divide it by the total number of orders. This will give you the average amount customers spend on each order, helping to understand your business's revenue per transaction.

For example, if your revenue since January 2022 till today is $3M, and you’ve made 19,354 sales, then the [AOV = $3M / 19,354 = $155]

Step 2: Identify the frequency of transactions

Track how often individual customers make purchases from your business within a specific period. To measure the total number of orders made by each customer during that time - just divide the number of transactions by the number of customers.

For example, we already know that over the last 18 months or so you’ve made 19,354 sales, and you have 6,451 customers then the [Frequency = 19,354 / 6,451 = 3].

For instance, if a customer makes three purchases every month (like in typical SaaS model), their transaction frequency is [1 x number of months in the period]. This information helps you understand how frequently customers engage with your business and how often they return for purchases.

Step 3: Measure customer retention

Determine the average length of time customers stay loyal to your business by analyzing the period between a customer's first purchase and their last transaction. Calculate the average time duration across all customers.

For example, if customer A remains a client for six months, customer B for one year, and customer C for two years, the average customer retention would be 3.5 / 3 = 1.17 years.

Step 4: Calculate LTV

Here's a quick look at how you can calculate LTV for one customer:

OR

For instance, consider an online shop with an average order value of $20. Customers visit two times a month, and on average, they remain loyal for two years.

LTV = $20 (average order value) × 2 (monthly transactions) × 24 (months of loyalty) = $960

In this example, the LTV is $960.

Based on this information, you can create an action plan to maximize your Customer Lifetime Value, such as offering loyalty programs, upselling, or offering combo deals, and ultimately, drive higher revenue for your business.

How to Boost Customer Lifetime Value

Boosting LTV can increase your business profits in the long run. Here are some simple ways to improve customer loyalty and keep them coming back for more.

Uncover in-depth insights

5 simple ways to calculate customer LTV

Download nowBonus for readers

Invest in Customer Experience

According to this Forbes research, 86% of customers are willing to pay more for a better experience. By providing exceptional service, you create loyal customers who are more likely to make repeat purchases and refer others.

Incentivize a Loyalty Program

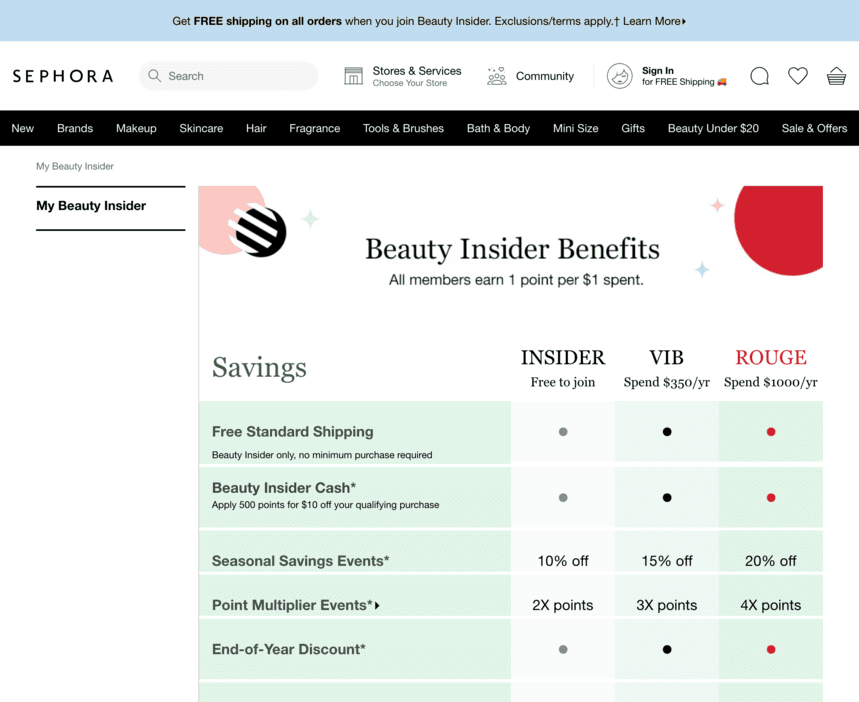

Reward programs can effectively boost customer loyalty and retention. Add gamified elements, like discounts and perks upon reaching milestones such as the first purchase or a specific spending threshold, so you can further engage with the customers.

For example, the Sephora Beauty Insider program offers members’ only early access to products, personalized beauty recommendations, and special gifts to the past buyers, resulting in improved customer loyalty and engagement.

Improve Onboarding Processes

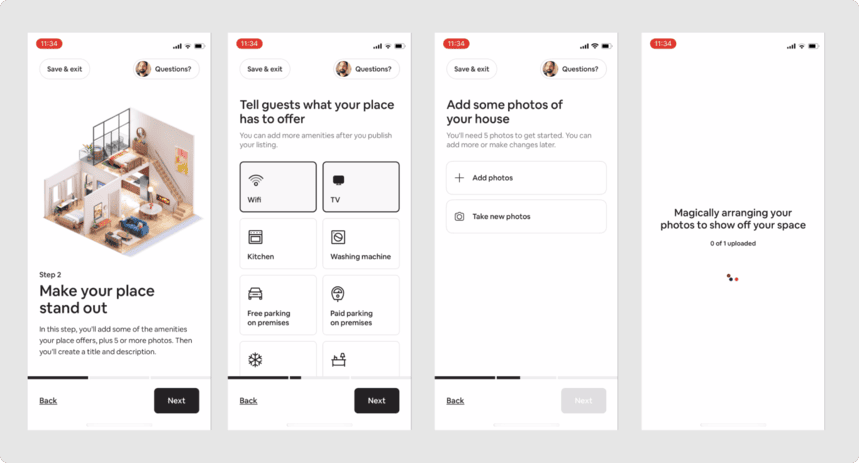

If you are in a SaaS or fintech niche, the onboarding process is very important to succeed, as it influences how customers feel about the company, the brand and whether they stick around. Surveys have shown that when onboarding is smooth and easy, 76% of customers stay with the business.

However, in the software industry, many customers, about 60-70%, drop off after signing up for a trial due to a poor onboarding experience.

The companies should focus on making the sign-up process simple, personalizing the experience for each groups of customers based on their similarity (or specific customer), and providing clear instructions.

A good example is Airbnb's personalized onboarding, during which they ask new users about their travel preferences to suggest suitable listings and tailor the offering to their needs.

Prioritizing seamless onboarding can lead to happier customers, increased loyalty, long-term relationships with the business, and to higher LTV.

Recognize and Reward Your Best Customers

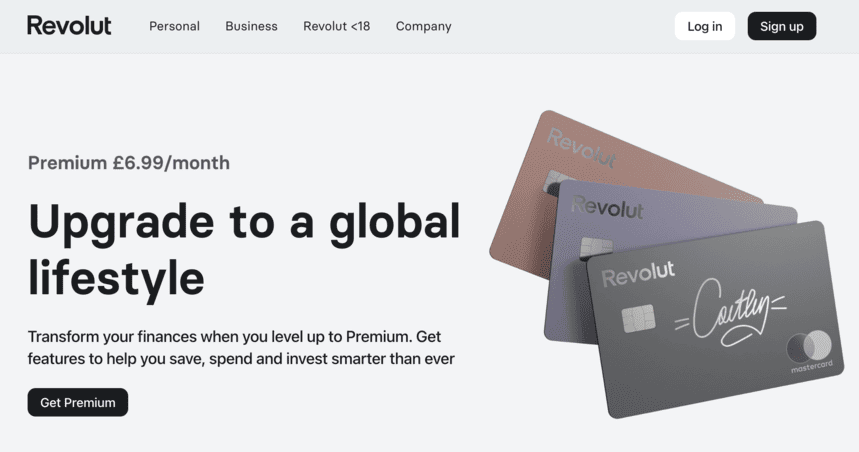

Customers are nearly five times more likely to leave a business because they feel the company is indifferent to them rather than being dissatisfied with the product or service. By recognizing the value of your top customers and offering exclusive benefits or personalized rewards, you can create a sense of belonging and encourage long-term loyalty.

For example, Revolut offers a premium membership plan with additional benefits like higher transaction limits, exclusive access to new features before other users, priority customer support, and special discounts on partner services. By providing these extra perks to their most valuable customers, they can ensure that these customers feel appreciated and well taken care of, which can lead to higher customer retention.

Provide Omnichannel Support

To build customer trust and loyalty, companies should offer seamless interactions across multiple platforms, including websites, apps, and social media. Customers should be able to access their accounts and preferences easily, no matter which platform they are using. Creating a responsive design ensures that customers have a consistent experience whether they are using a computer, tablet, or phone.

Use Social Media

To boost LTV using social media, focus on engaging content that resonates with your audience, such as infographics, interactive quizzes, or engaging gamifications. Communicate with customers promptly and offer exclusive promotions to encourage repeat purchases and loyalty. Collaborate with influencers to expand your reach and build credibility. Encourage user-generated content to foster trust and authenticity. Additionally, practice social listening to gather feedback and improve your products and services.

Closed-Loop Feedback

Address customer concerns promptly and make improvements. Listen to their questions, suggestions, and preferences, and use this information to improve your service. By showing customers that their opinions matter and implementing changes based on their feedback, you make sure that they are more likely to remain loyal and continue their relationship with your business, leading to increased LTV.

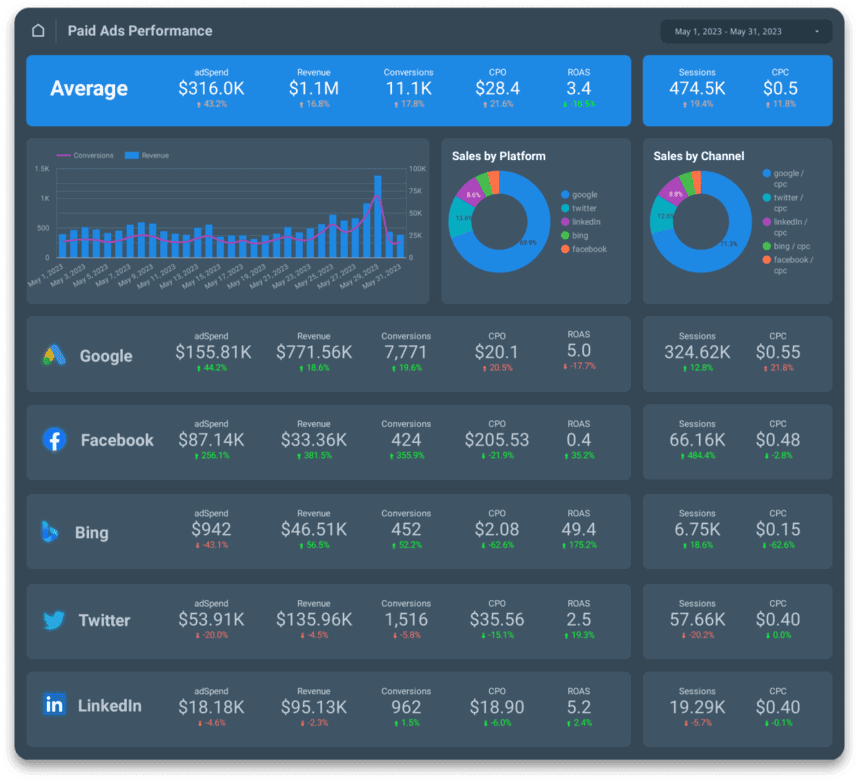

Optimizing LTV with OWOX BI

With OWOX BI, optimizing LTV is easy. You'll gather data from different channels to get consolidated information visualized and automatically updated, helping you keep an eye on total and completed orders, average revenue per user, compare AOV, CAC and LTV, and more to understand your customers better.

Then, armed with fully-automated reports in one place, you can see how effective your ads (or other channels) are and increase the chances of customers making purchases.

You can also find opportunities to offer them related products or upgrades by accurately tracking their behavior, keeping them engaged and growing your revenue in the long run.

Easily prepare your data for reporting with OWOX BI and predict LTV value and boost ROI

Key Takeaways

Customer Lifetime Value (LTV) shows how valuable a customer is to a business over time and helps engage them with offers and rewards.

LTV is important for businesses with continuous relationships, like streaming platforms and SaaS, as it helps with profits, decisions, and growth strategies.

You can boost LTV by focusing on customer onboarding, rewarding loyal customers, and providing seamless support across different platforms.

FAQ

-

Why Is Customer Lifetime Value Important?

Knowing Customer Lifetime Value is important for businesses because it helps plan marketing, keep customers coming back, and make smart decisions for the future. It shows which customers are most valuable and where to invest resources for the best results. -

How Is Customer Lifetime Value Calculated?

To find Customer Lifetime Value, you multiply the average amount a customer spends on each purchase by how many times they buy from you per year and how long they stay as a customer. -

What Is Customer Lifetime Value (LTV)?

Customer Lifetime Value (LTV) is a way to see how much a customer is worth to a business over time, showing how they affect revenue in the long run.